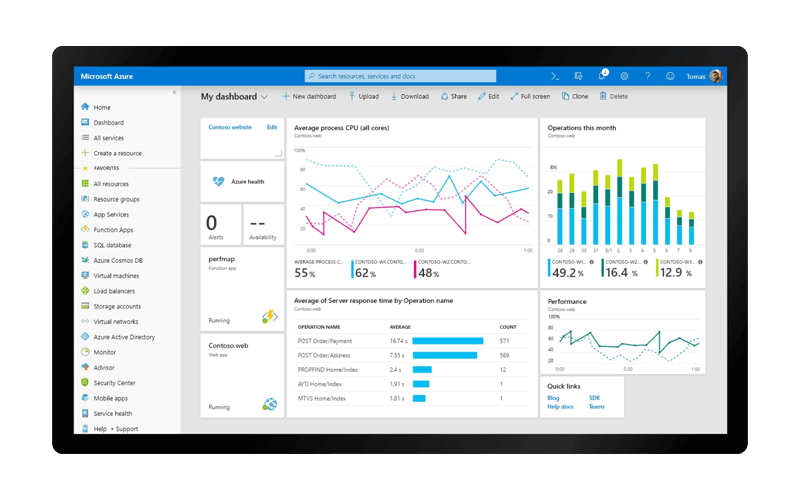

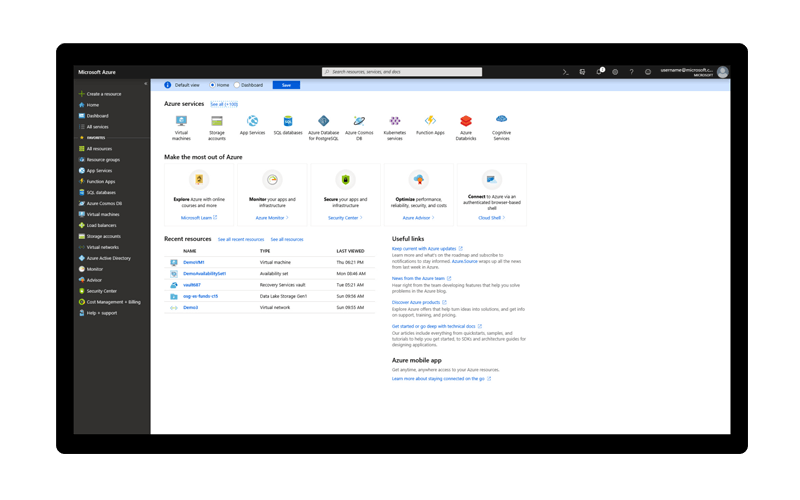

Microsoft Azure

Move faster and save with integrated cloud services, including analytics, computing, mobile, networking, storage, web and more.

Get more done with Azure cloud services.

The integrated tools, templates and services in Azure® make it easy to build and manage enterprise, mobile, web and Internet of Things (IoT) apps. Use your existing skills and technologies to move faster in the stable Microsoft® environment you’re familiar with.

As a certified Microsoft Azure Managed Services Provider (MSP), we're uniquely qualified to help you get the most out of your Azure solutions.

Comprehensive support

Our managed services provide a reliable foundation for your Azure environment. With Insight Cloud Care, you’ll receive management, consulting and monitoring structured around your business goals.

Learn more

Superior productivity

Build, deploy and manage applications with Azure. It's the only major cloud platform classified by Gartner as an industry leader for both Infrastructure as a Service (IaaS) and Platform as a Service (PaaS).

An open cloud platform

Stick with what you know and trust. Azure supports the broadest selection of operating systems, programming languages, frameworks, tools, databases and devices. Run the operating system of your choice, code apps how you wish and create back ends for Android and Windows® devices.

Expand your existing IT.

You don't have to choose between your data center and the cloud. Integrate the cloud with your existing IT environment through the largest network of secure private connections, hybrid databases and storage solutions.

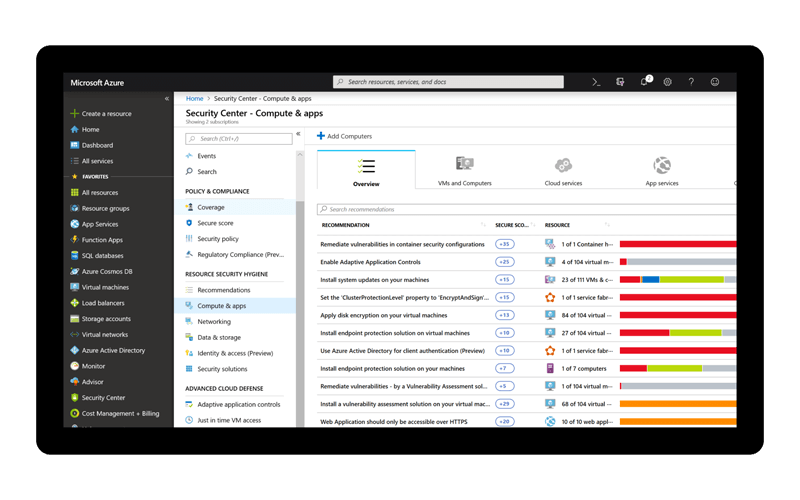

A commitment to securing your data

With Azure, Microsoft is on a mission to protect your data. The company is leading the way in adopting new standards and has been recognized internationally for its work.

In fact, Azure Government, a stand-alone version of Azure, meets the rigorous compliance requirements of U.S. public agencies.

Scale at your pace.

Pay-as-you-go Azure services can quickly scale up or down to match your needs. You only pay for what you use. Azure is committed to billing that suits your organization and matching competitor prices.

Insight is the proud recipient of the Microsoft U.S. Azure Team Partner Choice Award for Data and Artificial Intelligence.

Additional Azure services

Build a solution that meets your specific business needs.

- API Management

- Application Gateway

- App Service

- Automation

- Backup

- Batch

- BizTalk® Services

- Cloud Services

- Content Delivery Network

- Data Catalog

- Data Factory

- Data Lake Analytics

- Data Lake Store

- Defender for Cloud

- Azure DevTest Labs

- Domain Name System

- DocumentDB

- Event Hubs

- ExpressRoute®

- HDInsight®

- IoT Hub

- Key Vault

- Load Balancer

- Machine Learning

- Managed Cache Service

- Media Services

- Microsoft Entra® B2C

- Microsoft Entra

- Microsoft Entra Domain Services

- Microsoft Sentinel

- Mobile Engagement

- Mobile Services

- Multi-Factor Authentication

- Notification Hubs

- Operational Insights

- Redis Cache

- RemoteApp®

- Scheduler

- Search

- Service Bus

- Service Fabric

- Site Recovery

- SQL Database

- SQL Data Warehouse

- Storage

- StorSimple®

- Stream Analytics

- Traffic Manager

- Virtual Machines

- Virtual Network

- Visual Studio® Application Insights

- Visual Studio Team Services

- VPN Gateway